Michigan offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Consumers Energy Rebates

Michigan Renewable Energy Certification System

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Michigan Government

Michigan State Capitol Commission

100 N. Capitol Ave.

Lansing, MI, 48933

(517) 373-1433

MSCC@ legislature.mi.gov

Hours: M-F 8:00am – 5:00pm

DTE Energy

One Energy Plaza

1189 WCB

Detroit, MI 48226-1221

Residential Assistance

(800) 477-4747

Business Assistance

(855) 383-4249

Online Assistance

(800) 482-8720

Hours: M-F 8:00am – 5:00pm

Michigan Department of Environment, Great Lakes, and Energy

Constitution Hall

525 West Allegan Street

P.O. Box 30473

Lansing, MI 48909-7973

(800) 662-9278

[email protected]

Hours: M-F 8:00am – 4:30pm

Grand Rapids Weather Bureau

4899 Tim Dougherty Drive SE

Grand Rapids, MI 49512-4034

(616) 949-0643

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| 2024- | Ad Valorem Real Property Tax Exemption for a term of 20 years | Owners of utility-scale solar energy generation facilities who build a new solar energy facility |

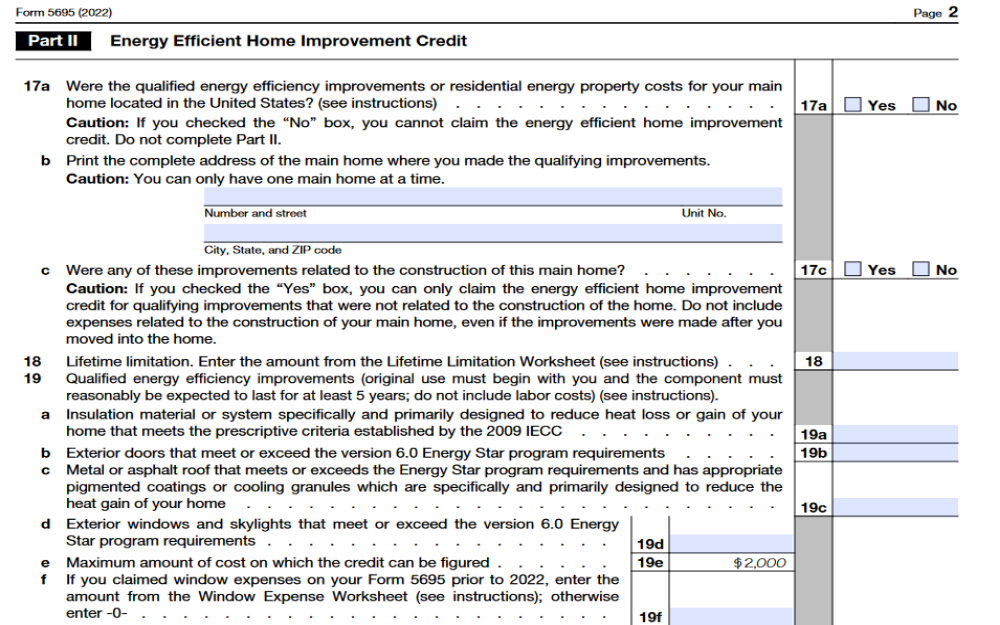

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Michigan Department of Environment, Great Lakes, and Energy

MI Healthy Climate Plan

Funding Opportunities

MI Solar for All

Michigan Home Energy Incentives Calculator

Home Energy Rebate Programs

Contact

Power Outage Map

Michigan Department of Environment, Great Lakes, and Energy

Phone: (800) 662-9278

Email: [email protected]

Monday – Friday

8 AM – 4:30 PM

Constitution Hall

525 West Allegan Street

P.O. Box 30473

Lansing, MI 48909-7973

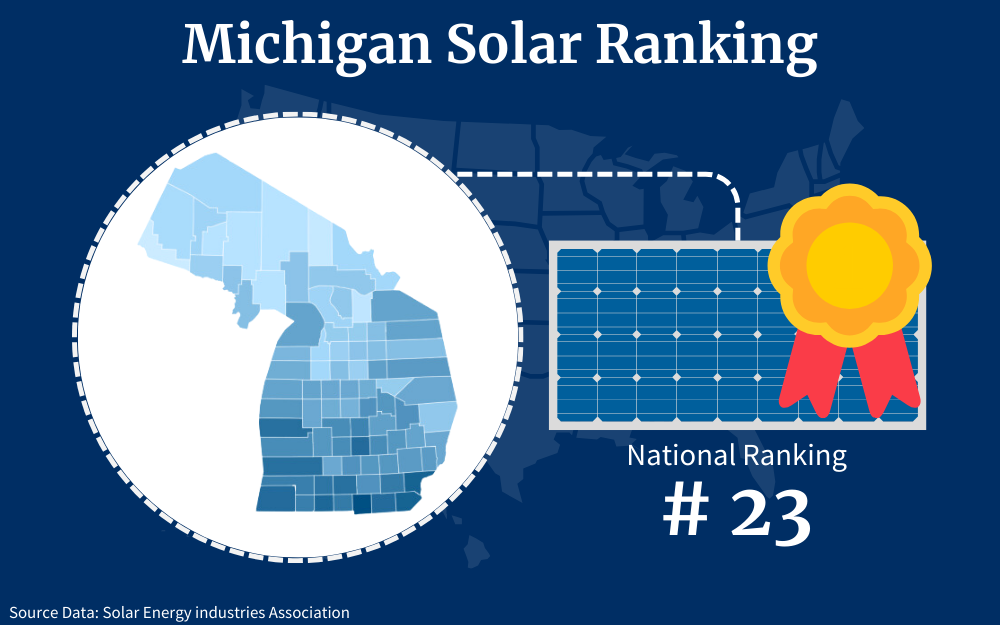

Michigan Solar Credits Overview

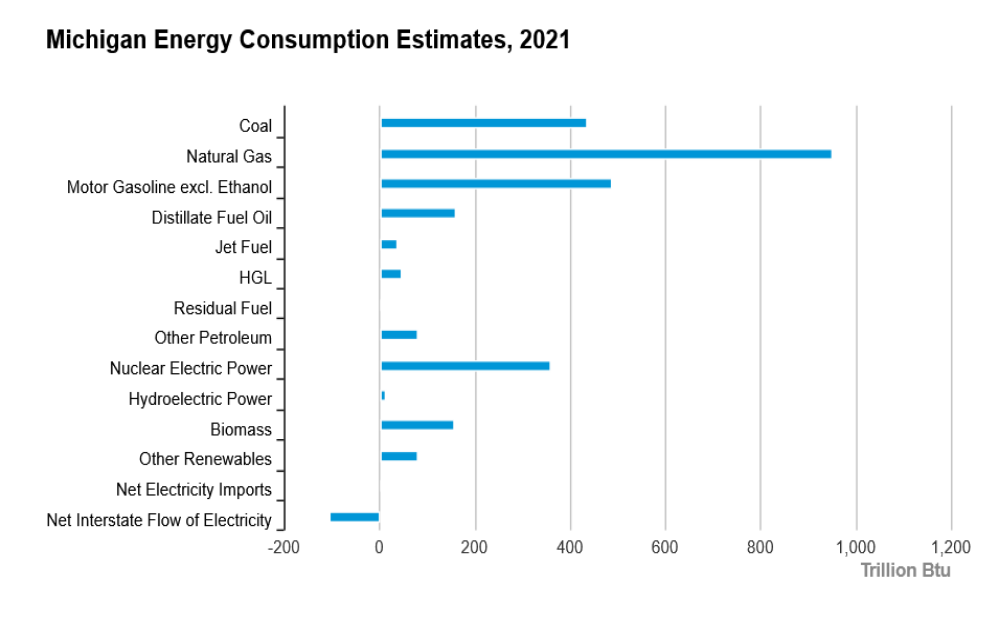

Solar energy is a key player and almost every state offers federal solar incentives. Currently, Michigan ranks as 23rd in the nation for solar energy adoption, but that’s rapidly changing thanks to the fact that solar energy is cheap and can significantly reduce energy bills.

Such incentives increase the popularity of installing home solar panels energy systems and since 2009, solar power panels have become 90% more affordable.2

This guide explores government solar programs offered by the state of Michigan and the federal government. It explains how solar power and Michigan solar incentives can legitimately save you money and decrease your household’s dependence on the power grid.

Clean Energy for Low-Income Accelerator (CELICA)

Michigan offers multiple incentives for renewables under an all-encompassing initiative, including Michigan solar credits. The “Clean Energy for Low-Income Accelerator” (CELICA) program is a fine example.3

Programs like this are set up to make sure that the adoption of and access to alternative clean energy in the state continues to develop.

CELICA is presently between stages three and four. The program has expanded from planning to implementation of solar for fifty low-income households in Lansing, MI.

CELICA isn’t the only option. From the lowest to the highest echelons of Michigan society, there are incentives available, including more general solar programs providing incentives for the state.4

This list of all renewable options for MI can give you an idea of what’s available.5 Here we’ll explore prominent social incentives, including:

- The Lansing Board of Water & Light Solar Rebate

- The “Michigan Saves” Home Energy Loan Program

- The Alternative Energy Tax Exemption

- The Distributed Generation Program

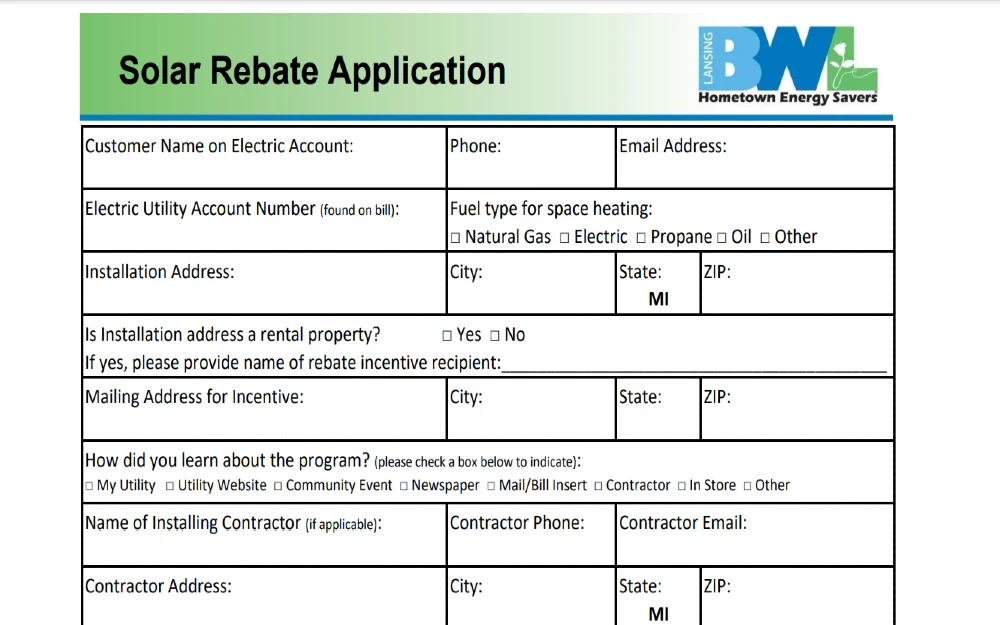

The Lansing Board of Water and Light Solar Rebate

The Board of Water and Light (BWL) is the primary incentive provider here. A kilowatt is 1,000 Watts.

BWL will provide residents of Lansing a $500 rebate for each kilowatt of solar energy installed, which substantially curbs materials acquisition expenses. This rebate is good for up to 4 kilowatts of installed energy or $2k in rebates.

Here’s how to apply for the rebate:6

- Download or Print the form.

- Enter relevant information; if you don’t have it handy, read through to find what you need.

- Be sure you know how many kilowatts you’ve installed for the rebate section.

- Don’t forget to include an equipment invoice with the application form when you mail it off. This will need to include the date of installation, and spec sheets indicating power efficiency ratings.

- Assure you include documentation that has the serial number of your renewable equipment.

- Double-check to make sure you got the details right; incomplete application packages are automatically denied.

The “Michigan Saves” Home Energy Loan Program

Not everyone can afford to immediately spend thousands of dollars on solar installation, which is why Michigan has a loan program in place.

This program offers options on 150+ improvements for varying homes,7 most notably associated solar alternatives.

The Alternative Energy Tax Exemption

If alternative renewable energy projects on a property cost less than $80,000, property tax increases are exempted in Michigan.8

That means if your home is worth $100k, and you added $79,999 in property value through solar or other renewables, Michigan would not include that $79,999 on your property’s value assessment. Your property tax would not increase.

The only caveat here is that associated renewable options must offset “all or a portion” of energy use after installation.

The Distributed Generation Program

Net metering has been reimagined in Michigan through the Distributed Generation Program.9 Basically, there’s not a “set rate” for extra electricity produced by your solar array.

As long as it can be sent to the grid, you’re able to enjoy associated benefits with no “cap.” The only “cap” comes in the size of the energy array you install.

Solar energy can exceed hourly capacity. A five-kilowatt array averages about 20 kWh of energy a day,10 or 600 a month.

Federal Government Solar Incentives

There are also federal incentive programs to explore, including:

- EERE: Energy Efficiency and Renewable Energy

- The Residential Clean Energy Credit Through the ITC

- Production Tax Credits: PTC

EERE: Energy Efficiency and Renewable Energy

The Department of Energy has a specific division called EERE. EERE stands for Energy Efficiency and Renewable Energy.

EERE invests in renewable energy options and technology across the country, adhering to solar panel regulations. It is EERE’s prerogative to facilitate competitive options for further enhancement of renewable options.11

To apply you’ll need to complete an RFI, or Request For Information. EERE examines your RFI and works with you to acquire all relevant data.

Once enough has been gathered, a Notice Of Intent (NOI) is announced, and then a Funding Opportunity Announcement or FOA is issued.

Those making applications can put together information regarding the renewable energy options they’re exploring.12 EERE in Michigan primarily serves businesses, but private individuals might secure solutions in funding as well.

The final result may not match initial proposals, and sometimes funding isn’t issued. However, the opportunity exists.

Through EERE, over 11,000 kilowatts have been installed across Michigan.

The Residential Clean Energy Credit Through the ITC

ITC stands for Investment Tax Credit. It’s one of several federal options nationally available.20

There’s a 30% federal tax credit for renewable energy installed in the decade bridging 2022 and 2032. In 2033, the credit is set to drop below 30%.

Production Tax Credits: PTC

PTC options are geared more toward businesses. They are based on kilowatt hours, represented kWh, that a company produces.

The more kWh you produce, the greater your adjusted income tax liability is reduced. This incentive is annually adjusted for inflation federally.

To be eligible, corporate renewable projects must begin prior to January 1, 2025. Anything beginning after that is only eligible for the Clean Electricity Production Tax Credit (CEPTC).

CEPTC doesn’t become available until after December 31, 2024.13

What Is Needed To Qualify for Solar Credits?

You might wonder, “What if I don’t own the house, can I take the tax credit?”

Generally, you cannot claim the Tax Credit if you don’t own the home, as it usually requires ownership of both the property and the solar energy system.

Even though different solar credits and incentives have different prerequisites, all of them are created to encourage people to switch to using solar panel systems, or other renewable energy sources, and increase renewable energy production.

With the incentives listed below, they helped Michigan rank 23rd among all states when it comes to solar capacity.

ITC and PTC Claims

If you are wondering, “What forms do I need for solar tax credit?” you will need to fill out particular IRS forms.

To claim the federal ITC, you must complete an IRS form 5695.28 To apply for a PTC, you’ll want to follow the instructions for form 8962.29

Here are the steps in filling out IRS form 5695:

Step 1: Obtain the Form: Download Form 5695 from the official IRS website or request a copy from a tax preparer or local IRS office.

Step 2: Check Eligibility: Ensure that you are eligible for the tax credit. Review the instructions or consult with a tax professional if needed.

Step 3: Gather Necessary Documents and Information: Collect all relevant documents and information, including receipts and records of expenses related to your eligible energy improvements.

Step 4: File Your Tax Return: If you’re filing electronically, follow the instructions provided by your tax software or e-filing service.

If you’re filing a paper return, make sure to attach Form 5695 and any supporting documents.

This is an IRS form like a 1040, though it’s more in-depth and requires detailed information. Essentially, for either ITC or PTC, you fill out the associated tax document and include it with your 1040.

Solar Rebate Acquisition

For the rebate, you’ll need to fill out an application form.6 Qualification requires purchasing and installing equipment, and then signing an interconnection application.

Be sure to attach a copy of an invoice with the form that shows installation and specs for stating efficiency.

Assure the application is fully completed and signed, and that it includes documentation with model and serial numbers. Incomplete applications are denied.

Home Energy Loan Info

There are websites that detail application information for attaining associated loans.7 In a nutshell, you will want to go through a credit union offering such financial assistance.

TRUE Community Credit Union and Michigan Saves provide loans, but the way they underwrite differs, and you may not be approved by both. You’ll need an authorized contractor in your area to fill out the application, as they’ll have a particular number associated with them that the application requires.

What makes sense is contacting contractors, and then contacting either of the listed lending centers to see if your financial profile is something they’re willing to underwrite. If it is, you simply provide them the contractor’s identification number and they’ll guide you through the process.

Distributed Generation

Consumers Energy and DTE Energy represent 92% of customers in Michigan, the other 8% are smaller operations. For Distributed Generation credits, simply discuss your new solar array with your energy company, and they’ll provide details specific to your situation.

It may be worthwhile to explore what other regional energy companies offer in terms of Distributed Generation.

Home Equity Tax Reduction

Michigan won’t assess the value of your home as greater should your renewable energy upgrades be worth less than $80k.

Can I Sell Power Back to the Grid? MI Solar Farms

Michigan has had Power Purchase Agreements, or PPAs since 2016.24 PPAs for Michigan residential persons are covered under the Distributed Generation Program.9

While there’s no “set rate” for how much residents can receive for over-production, there’s a 150-kilowatt cap for a given system. Most homeowners won’t have a system that produces more than 25kWhs on an average day, so this limit doesn’t apply to them.

Essentially, you’ll be compensated for the on-site generation of energy sent to distribution generation hubs. Rates may vary, but it is possible to offset solar installation costs and more this way.

It’s basically net metering,26 but under another name.27

Solar Panel Installation Costs

Current estimates for solar system installation in MI, minus incentives, are $3.50 per Watt.14 So 1,000 Watts (1 kilowatt) would cost $3,500. So a 5kWh system would be about $17,500.

Range estimates presently put the total cost of materials acquisition and installation between $14,000 and $21k, depending on the quality of materials used, how many panels are installed, and what level of installation expertise is brought to the table.

The assumption here is that a business or homeowner installing a solar array is working with professional contractors to get the job done. DIY installation can drop the cost by 25 to 71 percent, depending.

On Amazon, you can find photovoltaic solar panels as cheap as just .29 cents per Watt. At that rate, you could acquire 5kWh in panels for $1,450, then acquire the cords, power inverters, surge controllers, batteries, and mounting brackets for less than $3k.

It’s conceivable a solar array could be installed in MI for less than $5k, and from there, applications for varying incentive programs could be pursued. The issue is that you get what you pay for.

Inexpensive panels tend to have a shorter solar panel life expectancy. If you save $12,500 on the front end only to spend $15,000 on the back end over time, you really haven’t saved anything.

It’s better to pay more upfront, and less on the back end. At a minimum, consult with local installation pros to get an idea of what equipment is best.

Installation is straightforward, though for most homeowners it requires risky hours spent on a rooftop. You may also wonder, “What if the solar panels are not on my roof?”

In such cases, the installation costs and procedures could vary, and it would be best to consult with professionals for accurate estimates.

Solar Panel Calculator: Requirements and Cost Savings

To calculate savings accurately, several key variables must be considered, which a solar energy savings calculator can help with.

Primary variables influencing savings include:

- Potential property value increase

- Available state incentives

- Available federal incentives

- Equipment expenses

- Installation expenses

- Utility cost deferral

Potential Property Value Increase

It’s estimated solar panels increase property value by 4%.15

For a $100k house, that’s an increase of $4k. For a $500k house, that’s an increase of $16k.

It is also estimated that the average property value expansion a solar array brings is $15k. The U.S. Department of Energy stated in 2015 that solar arrays increase property value by $15k on a typical PV (photovoltaic) solar array.16

Since inflation estimates are 3.23% from 2015 to today,17 that could indicate a property value increase on a PV array of $18,876. Since the average cost of a house in Michigan as of August 31, 2023 is $237,028, that provides enough data to calculate a property value range.18

On the low end, the average increase for a solar array in MI should be $9,481.12, on the high end it could be $18,866 or higher.

Available State Incentives

Rebates are available for each kilowatt you install up to 4 kilowatts in Lansing. Properly installed systems at 4+ kilowatts can save you $2k.

Also, with the “Michigan Saves” Home Energy Loan Program, you could potentially defer total installation cost as you would property acquisition cost. Think of this loan program as a renewable energy mortgage.

A properly installed system can offset grid-based energy. Your monthly bills may remain similar, but now your energy payment goes to property equity rather than an electric company till the loan is paid.

Any renewables installed on MI property are tax-exempt up to $80k. Property value in Michigan varies per county and city, but the state’s average is 1.32 percent.19

Any renewables installed on MI property are tax-exempt up to $80k. Property value in Michigan varies per county and city, but the state’s average is 1.32 percent.19

So for a home valued at $237,028, that would mean an annual taxation of $3,128.76. If a solar array increased that property’s value by $15k, that would be an annual tax bill of $3,326.76.

So on average, Michigan homeowners will save $198 a year on property taxes while enjoying equity expansion.

Michigan’s version of net metering, Distributed Generation, allows homeowners to recoup overages in energy production. Provided your solar array is less than 150 kilowatts, you can see a direct return for overproduction.

It is entirely possible to generate enough electricity that all energy needs are recouped this way, ultimately paying you back.

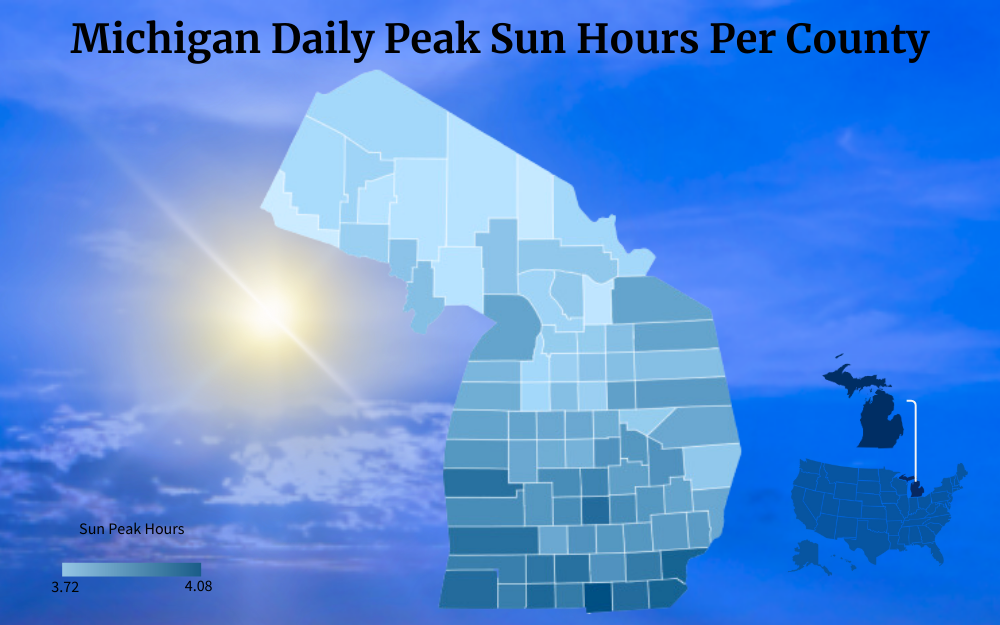

However, MI has snow, lake-effect snow, rain, wind, and the rest. This means you also have to consider how much sunlight exactly you’ll be able to get per your location.

Your system would have to be exceptionally robust to consistently over-produce at that level. It’s not impossible, but this may be a more feasible option for businesses doing this calculation than residential homeowners.

Available Federal Incentives

There are three primary federal incentives in Michigan; funding application through EERE, the Investment Tax Credit, and the Production Tax Credit. ITC is for residential homeowners and allows them to claim 30% of installation costs as an exemption from their income tax through the residential solar credit.

A $20k installation fee would net $6k in tax credits, lowering annual income tax by that amount. Depending on your tax bracket, this can be a substantial discount; it will differ per case.

Federal income tax ranges from 10% to 37%, depending on your bracket. So say taxable income was $20k for the year, before the ITC credit.

With the ITC credit, you’d be able to reduce that. On $20k, federal taxes would be something like $2k in the 10% bracket.

Well, now they drop to $1,400, saving you $600 for the year you install the PV solar panels.

For EERE, if your application is accepted, it’s possible to have your entire array paid for, and then it costs nothing; but this will require you to jump through some “hoops,” and certainly you’re not the first one to have this idea. EERE tends to be more appropriate for businesses exploring renewables.

The same is true of the PTC. Both will be variable based on, first, how good your proposal is to EERE, and second, your actual solar production levels.

Since businesses will vary widely on this point, this variable won’t be included in the calculation below; it’s just a point of data for commercial readers.

Equipment Expenses

Solar equipment expenses often range from $5k to $10k. That includes panels, brackets, cords, surge controllers, power inverters, batteries, battery arrays, travel expenses, shipping expenses, and more.

As indicated earlier, you can get the job done cheaper than $5k, but you’re going to sacrifice overall quality.

Installation Expenses

Installation tends to average $5k to $10k on top of equipment expenses, depending. It’s a very wise idea to shop around varying solar providers in Michigan to find the best deal and get an idea of which brands will serve your needs best.

Utility Cost Deferral

Michigan homes average 665 kWh of energy usage per month,21 at a price of 18.56 cents per kWh.22 That’s a monthly average of $123.424, or $123.43.

That means on average a family in MI spends $1,481.16 on energy annually. A solar array can totally cover that cost, but you’ll likely need to get one with a little more than 5 kilowatts, as those average 600 kWh per month.

You’ll probably want a 5.6kWh solar array to cover the average cost of energy, especially in Michigan’s cold winters. This will slightly increase your installation costs overall, but you’ll save on the back end by totally deferring grid-based energy expenses.

All Variables Calculated Together

At 3.5 cents per Watt, for a 5.6 kWh system, you’re looking at an average of $19,600 for a Michigan solar array that will totally cover your needs on average, and that’s assuming professional installation.

If you live in Lansing, you can subtract $2,000 from the 4-kilowatt rebate if your application is accepted, dropping that cost to $17,600.

You’ll save $1,481.16 (on average) in your first year, dropping that cost further to $16,118.84.

For a $19,600 installation expense, you’re looking at a $5,880 tax deduction. This could move you into a lower tax bracket.

Let’s assume the deduction cuts 10% of the credit from your costs, dropping the total first-year expense of your solar array to around $15,530.84.

With a property value hike of $15k on an average property value of $237,028, you’ll save another $198 a year through property tax deferral against that equity; so you can now call your real cost of installation $15,332.84.

The average real cost of a totally comprehensive solar array in MI will be $15,332.84 before you factor in utility deferral and property value increase. When you factor in equity, you’re looking at $332.84 in actual net worth reduction.23

You would pay $19,600 upfront for that, but rebates, tax reduction, utility reduction, and equity enhancement would mean your actual personal wealth reduction would only be $332.84.

Since equity is not liquid, we’ll factor that out and look at your cost over time. Excluding tax rebates and other incentives, the raw $19,600 cost for a 5.6 kWh array would be offset by utility reduction in approximately 13.23 years.

When you factor in equity, by your second year of owning a solar array, you have technically increased your net worth.

So, conceivably, if you installed a solar array 2 years before you sold a property, with the increased equity, you could see a direct profit. This is an ideal circumstance, but hopefully, you’re able to see how it’s possible, using the solar panel calculator as a guide.

(Note: add $2000 to the final figure if you don’t live in Lansing.)

Where To Buy Solar Panels in Michigan

Solar panels in Michigan can be purchased online, they can be purchased in brick-and-mortar department stores, and they can be purchased from solar installation companies.

Purchasing from installers can help you understand what is solar pv exactly, but tend to initiate whatever sales funnels such organizations manage, meaning they’ll try to sell the full installation package to you.

For the most part, you’ll need to contact Michigan solar companies, or purchase panels online.

There are many choices for solar energy credits and rebates in Michigan. Expect an array to cost $19,600 out-of-pocket, before considering any free solar offers.

Expect net worth to expand beyond that figure within several years’ time, provided you engage all tax credits, all rebates, and factor in a potential home equity increase.

Even without an equity increase, energy deferral per year could overcome the cost of solar installation within 13.25 years.

There will likely be periods through the years where Michigan solar incentives will not be as progressive and panels aren’t as perfectly productive, but the technology becomes more efficient all the time, panels also increase in affordability.

Registering for the available Michigan solar incentives will save you money while reducing your household energy emissions and making you independent from grid outages.

Frequently Asked Questions About Michigan Solar Incentives

Do Solar Panels Provide Enough Electricity in Michigan's Climate?

Given Michigan’s cold winters, it’s advisable to have a battery array that can supply power for a few days as a backup. But installing a solar system that meets your needs can still be extremely beneficial in Michigan, especially because they allow you to sell back surplus energy to the grid through Distributed Generation protocols.

What Is the Average Cost of Solar Panels in Michigan?

In Michigan, solar panels typically cost an average of 3.5 cents per Watt, including professional installation, amounting to $350 for a 100-Watt panel. While some panels may cost as low as 29 cents per Watt, these are generally lower in quality and require self-installation, and this estimate doesn’t consider any no cost solar options.

How Long Do Solar Panels Last on Average in Michigan?

The EPA reckons solar power panels will last 25 to 30 years.25 For Michigan’s climate, it would probably be wise to knock about 10 years off that figure. Expect panels to last 15 to 20 years with proper maintenance.

References

1Holowka, T. (2023, June 28). Research shows the U.S. about to experience a clean energy boom. Retrieved September 5, 2023, from <https://www.usgbc.org/articles/research-shows-us-about-experience-clean-energy-boom>

2Scheltens, L. (2023, April 13). How solar energy got so cheap. Vox Media. Retrieved September 5, 2023, from <https://www.vox.com/videos/23682054/solar-policy-cost-us-germany-china>

3State of Michigan. (2023, July 12). Clean Energy for Low-Income Accelerator (CELICA). Department of Environment, Great Lakes, and Energy. Retrieved September 5, 2023, from <https://www.michigan.gov/egle/about/organization/materials-management/energy/renewable-energy/celica>

4Iscrupe, L. (2023, July 27). Solar Panels in Michigan: Installers, Costs and Incentives. CNET. Retrieved September 5, 2023, from <https://www.cnet.com/home/energy-and-utilities/michigan-solar-panels/>

5DSIRE. (2023). Programs. NC Clean Energy Technology Center. Retrieved September 5, 2023, from <https://programs.dsireusa.org/system/program/mi>

6Lansing Board of Water Light. (2023). Solar Rebate Application. Submit your completed application to: Lansing Board of Water Light. Retrieved September 5, 2023, from <https://www.lbwl.com/sites/default/files/inline-files/solar-rebate-application_0_1.pdf>

7Michigan Saves. (2023). Home Improvement Loans for an Energy-modern Home. Michigan Saves. Retrieved September 5, 2023, from <https://michigansaves.org/residential-homes/>

8Michigan League of Conservation Voters. (2023). SB 47: Alternative energy property tax exemption. Michigan League of Conservation Voters. Retrieved September 5, 2023, from <https://michiganlcv.org/legislation/sb-47-alternative-energy-property-tax-exemption/>

9State of Michigan. (2023). Distributed Generation Program Implementation. Michigan Public Service Commission. Retrieved September 5, 2023, from <https://www.michigan.gov/mpsc/commission/workgroups/2016-energy-legislation/distributed-generation-program-implementation>

10Peacock Media Group. (2023). 5kW Solar System Information And Pricing. SolarQuotes. Retrieved September 5, 2023, from <https://www.solarquotes.com.au/systems/5kw/>

11Energy Efficiency & Renewable Energy. (2023). What Types of EERE Funding Exist? Energy Efficiency & Renewable Energy. Retrieved September 5, 2023, from <https://www.energy.gov/eere/funding/what-types-eere-funding-exist>

12Energy Efficiency & Renewable Energy. (2023). How Do I Apply for EERE Funding? Energy Efficiency & Renewable Energy. Retrieved September 5, 2023, from <https://www.energy.gov/eere/funding/how-do-i-apply-eere-funding>

13Solar Energy Technologies Office. (2023, August). Federal Solar Tax Credits for Businesses. Energy Efficiency & Renewable Energy. Retrieved September 5, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>

14EnergySage. (2023, March 15). Solar Panel Cost in Michigan. EnergySage. Retrieved September 5, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/mi/>

15Brill, R. (2023, May 18). Do Solar Panels Increase Your Home’s Value? Forbes. Retrieved September 5, 2023, from <https://www.forbes.com/home-improvement/solar/does-solar-increase-home-value/>

16Lawrence Berkeley National Laboratory. (2015, January 1). Berkeley Lab Illuminates Price Premiums for U.S. Solar Home Sales. Berkeley Lab. Retrieved September 5, 2023, from <https://emp.lbl.gov/news/berkeley-lab-illuminates>

17Webster, I. (2023). Value of $1 from 2015 to 2023. Inflation Calculator. Retrieved September 5, 2023, from <https://www.in2013dollars.com/us/inflation/2015?amount=1>

18Zillow. (2023). Michigan Home Values. Zillow. Retrieved September 5, 2023, from <https://www.zillow.com/home-values/30/mi/>

19SmartAsset. (2023). Michigan Property Tax Calculator. SmartAsset. Retrieved September 5, 2023, from <https://smartasset.com/taxes/michigan-property-tax-calculator>

20Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 5, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

21Eisenbach Consulting, LLC. (2023). How Much Electricity on Average Do Homes in Your State Use? (Ranked by State). Electric Choice. Retrieved September 5, 2023, from <https://www.electricchoice.com/blog/electricity-on-average-do-homes/>

22US Energy Information Administration. (2023, August 17). Michigan State Energy Profile. US Energy Information Administration. Retrieved September 5, 2023, from <https://www.eia.gov/state/print.php?sid=MI>

23Ganti, A. (2023, March 9). Net Worth: What It Is and How to Calculate It. Investopedia. Retrieved September 5, 2023, from <https://www.investopedia.com/terms/n/networth.asp>

24State of Michigan. (2023). Resource Planning. State of Michigan. Retrieved September 5, 2023, from <https://www.michigan.gov/mpsc/regulatory/electricity/resource-planning>

25US Environmental Protection Agency. (2023, August 17). End-of-Life Solar Panels: Regulations and Management. Retrieved September 5, 2023, from <https://www.epa.gov/hw/end-life-solar-panels-regulations-and-management>

26Solar Energy Industries Association. (2023). Net Metering. Solar Energy Industries Association. Retrieved September 5, 2023, from <https://www.seia.org/initiatives/net-metering>

27State of Michigan. (2020, January). Michigan’s distributed generation program. Michigan Public Service Commission. Retrieved September 5, 2023, from <https://www.michigan.gov/-/media/Project/Websites/mpsc/consumer/info/tips/Net_Metering.pdf?rev=178e8e0e69ab4bc19cc3d359c3b540e1>

28Department of the Treasury Internal Revenue Service. (2022). 2022 Resedential Energy Credits Form 5695. Department of the Treasury Internal Revenue Service. Retrieved September 5, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

29Department of the Treasury Internal Revenue Service. (2022). 2022 Instructions for Form 8962. Department of the Treasury Internal Revenue Service. Retrieved September 5, 2023, from <https://www.irs.gov/pub/irs-pdf/i8962.pdf>

30Screenshot of Solar Rebate Application. Lansing BWL. Retrieved from <https://www.lbwl.com/sites/default/files/inline-files/Solar%20Rebate%20Application.pdf>